Your message was sent successfully!

Search Lawyers Near You

Welcome to the U.S. News Lawyer Directory – powered by Best Lawyers®. Through this page you can find experienced lawyers across the United States, ready to assist you with your legal needs. Search by name, legal topic, and/or location, to find the legal counsel that is right for you.

{{ resultText }}

{{ tag }} x

Clear All

There are no results for your search.

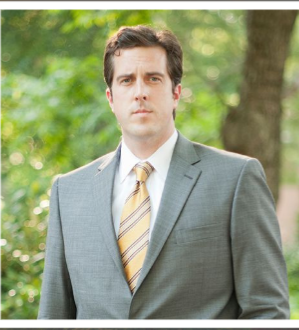

Sponsored Joshua W. Branch

Recognized by Best Lawyers® since 2024.

The Law Office of Joshua W. Branch LLC

Personal Injury Litigation - Plaintiffs

JOSHUA W. BRANCH MANAGING PARTNER THE ATHENS PERSONAL INJURY ATTORNEY Joshua W. Branch focuses on personal injury trial work. He has been representing clients in the Athens and Atlanta area for 18 years. Josh’s interest in law began... Read More.

Sponsored Larry W. Fouche

Larry Fouche

Criminal Defense: General Practice, DUI/DWI Defense, Injured Workers and Occupational Disease, Probate & Trust Disputes

Sponsored Ryan W. Gertz

Recognized by Best Lawyers® since 2022.

The Gertz Kelley Law Firm PLLC

Criminal Defense: General Practice

Born and raised in Beaumont, Ryan has deep roots in East Texas. His practice focuses mainly on state and federal criminal trial and appellate work throughout Texas. In fact, he is Board Certified in Criminal Law by the Texas Board of Legal... Read More.

Premium Neil T. Bloomfield

Moore & Van Allen PLLC

Administrative / Regulatory Law, Banking and Finance Law, Financial Services Regulation Law, Government Relations Practice

Premium Neil T. Bloomfield

Moore & Van Allen PLLC

Administrative / Regulatory Law, Banking and Finance Law, Financial Services Regulation Law, Civil Litigation

Premium Micah Bonaviri

Recognized by Best Lawyers® since 2024.

Stein Sperling Bennett De Jong Driscoll PC

Trusts and Estates

Premium Micah Dawson

Fisher Phillips LLP

Employment Law - Management, Labor Law - Management, Litigation - Labor and Employment

Premium Micah Miller

Recognized by Best Lawyers® since 2023.

Nutter McClennen & Fish LLP

Commercial Litigation, Litigation - Intellectual Property, Patent Law

Premium Micah Miller

Recognized by Best Lawyers® since 2023.

Nutter McClennen & Fish LLP

Commercial Litigation, Litigation - Intellectual Property, Patent Law

Premium Micah Prude

Thompson & Knight LLP

Litigation - Labor and Employment, Labor Law - Management, Employment Law - Management

Premium Micah Wissinger

Levy Ratner, P.C.

Labor Law - Union, Employment Law - Individuals, Discrimination & Harassment

Premium Micah R. LeBank

Recognized by Best Lawyers® since 2016.

Connelly Law Offices

Product Liability Litigation - Plaintiffs

Premium D. Micah "Micah" Royer III

Recognized by Best Lawyers® since 2019.

Coldwell Bowes L.L.P.

Family Law, Family Law Mediation

Premium W. Wylie Blair

Sandberg Phoenix & von Gontard P.C.

Personal Injury Litigation - Defendants, Product Liability Litigation - Defendants

Premium W. Keith Dozier, Jr

Wm. Keith Dozier, LLC

Personal Injury Litigation - Plaintiffs, Medical Malpractice Law - Plaintiffs, Professional Malpractice Law - Plaintiffs, Product Liability Litigation - Plaintiffs

Premium Jeffrey W. Acre

Recognized by Best Lawyers® since 2022.

K&L Gates LLP

Corporate Compliance Law, Corporate Governance Law, Mergers and Acquisitions Law, Securities / Capital Markets Law

Premium Jeffrey W. Acre

Recognized by Best Lawyers® since 2022.

K&L Gates LLP

Corporate Compliance Law, Mergers and Acquisitions Law, Securities / Capital Markets Law

Filter Lawyers

Contact

Login